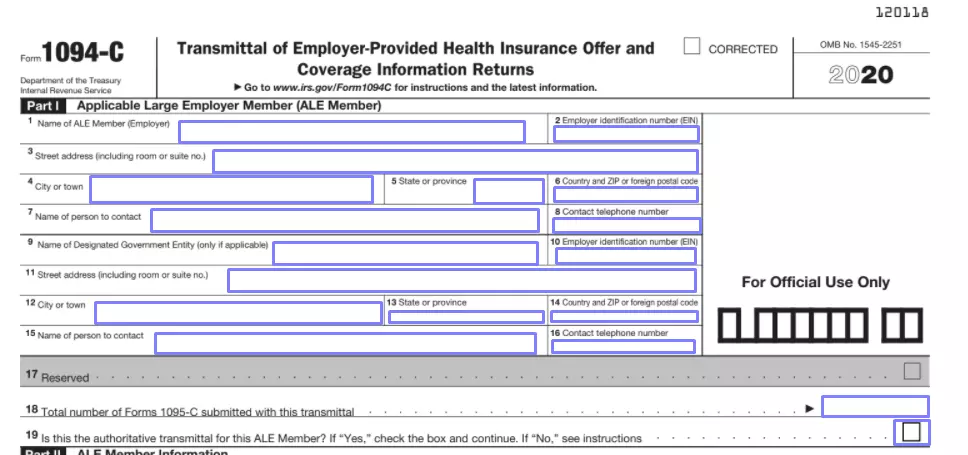

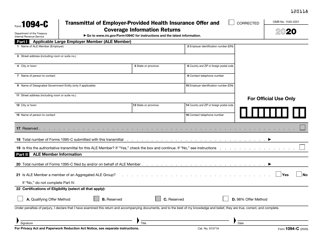

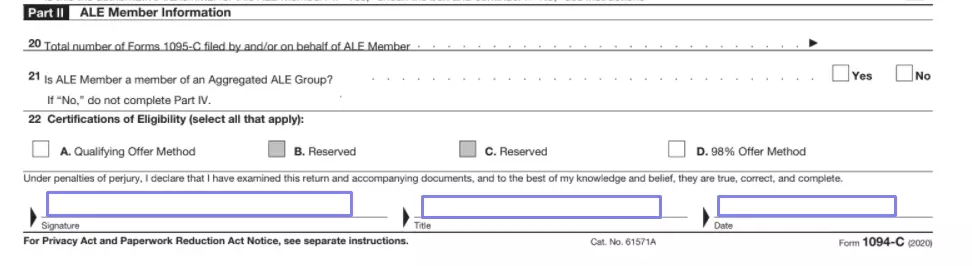

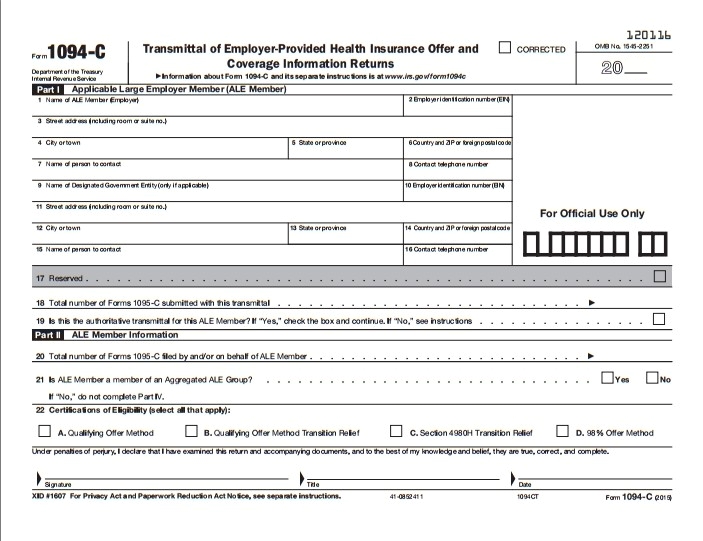

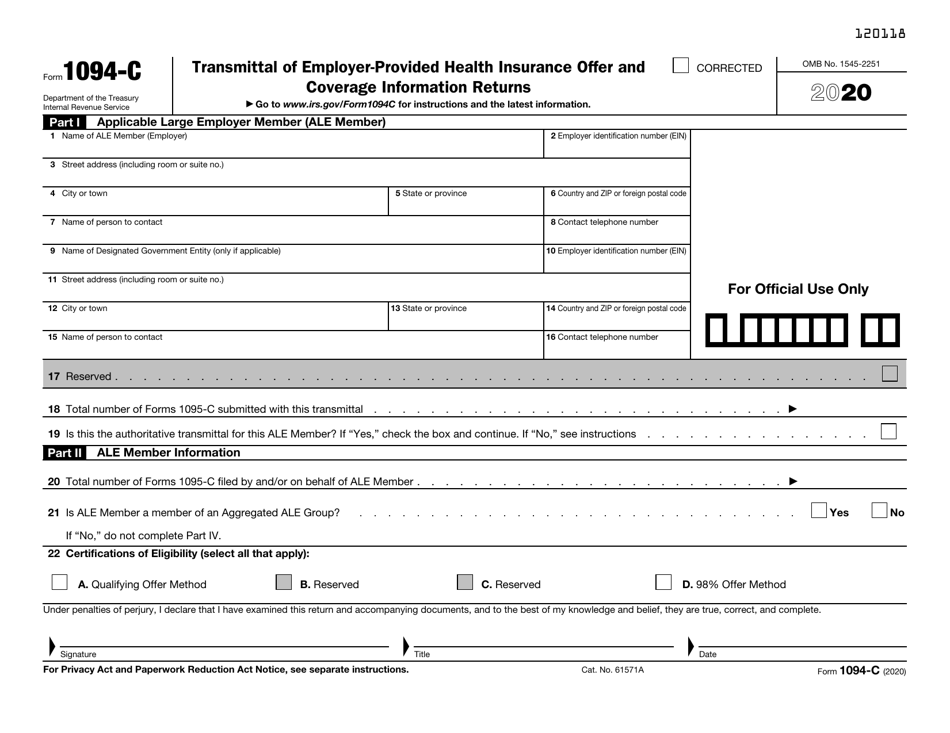

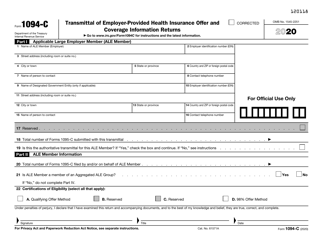

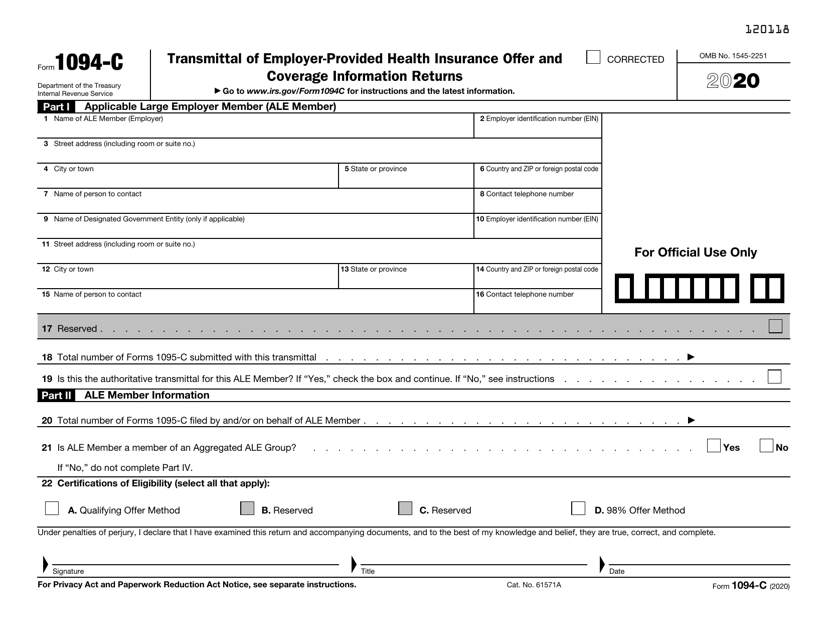

For electronic filers For forms filed in 21 reporting coverage provided in calendar year , Forms 1094B and 1095B are required to be filed by , or , if filing electronically ForPaper form W2 Wage Withholding Tax Return (DR 1094) To claim the credit, deduct the overpayment on line 2 of your return You may only deduct an amount bringing your return to zero (000) for the period you are reporting If you are unable to claim the credit on a subsequent DR 1094 within the calendar year, you should claim a refund on yourGet And Sign 1094 C Form 1721 And ZIP or foreign postal code 7 Name of person to contact 8 Contact telephone number 9 Name of Designated Government Entity (only if applicable) 10 Employer identification number (EIN) 11 Street address (including room or suite no)

About Form 1094 Turbo Tax

1094 c form 2019

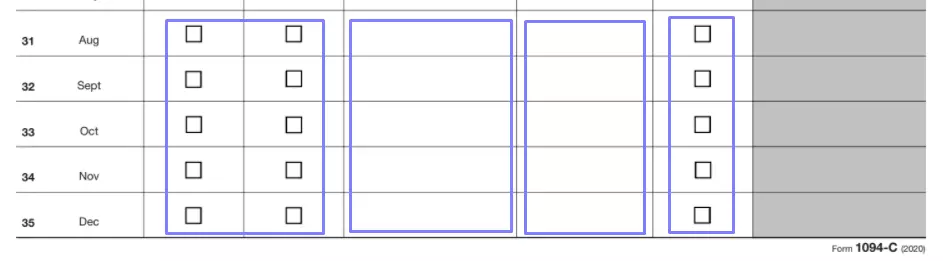

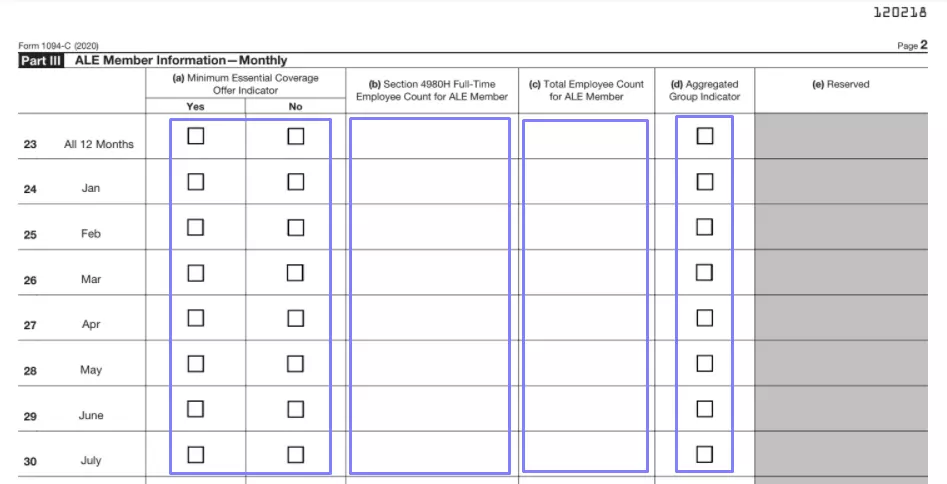

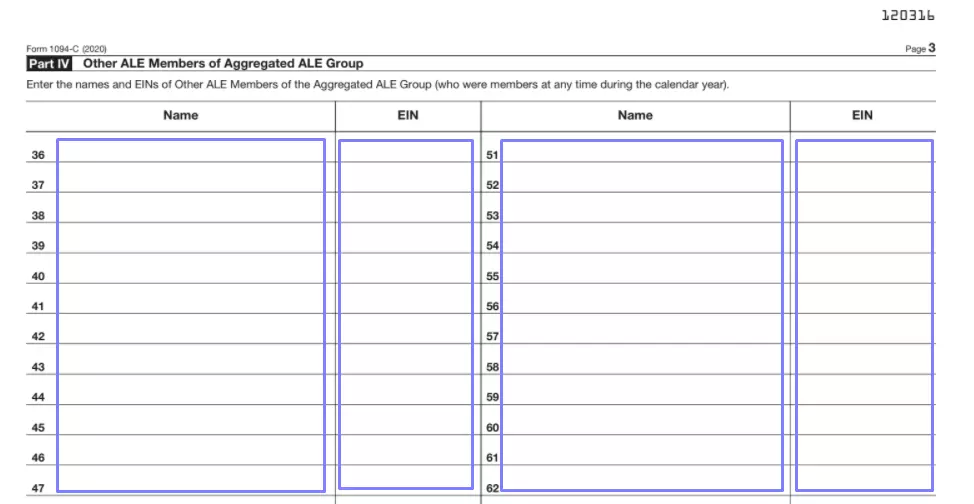

1094 c form 2019-Get IRS 1094C 21 Get form Title Cat No A Date Form 1094C 17 Page 2 a Minimum Essential Coverage Offer Indicator b Section 4980H FullTime Employee Count for ALE Member c Total Employee Count for ALE Member d Aggregated Group Indicator All 12 Months Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 1316 Page 3 Other ALEHowever, the relief provides an extension to The other reporting obligations under Code §§ 6055 and 6056 were not provided an extension Thus, insurers must still file the Form 1094B with the IRS by , and employers will need

What Is The Difference Between Forms 1094 C And 1095 C Turbotax Tax Tips Videos

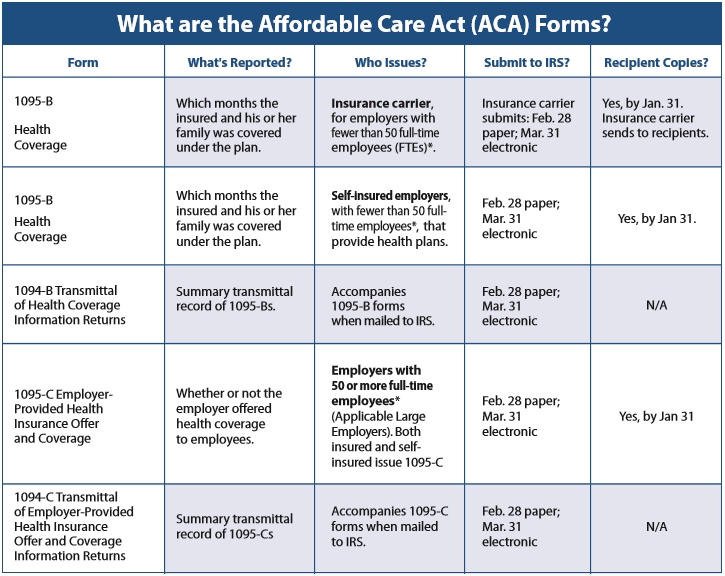

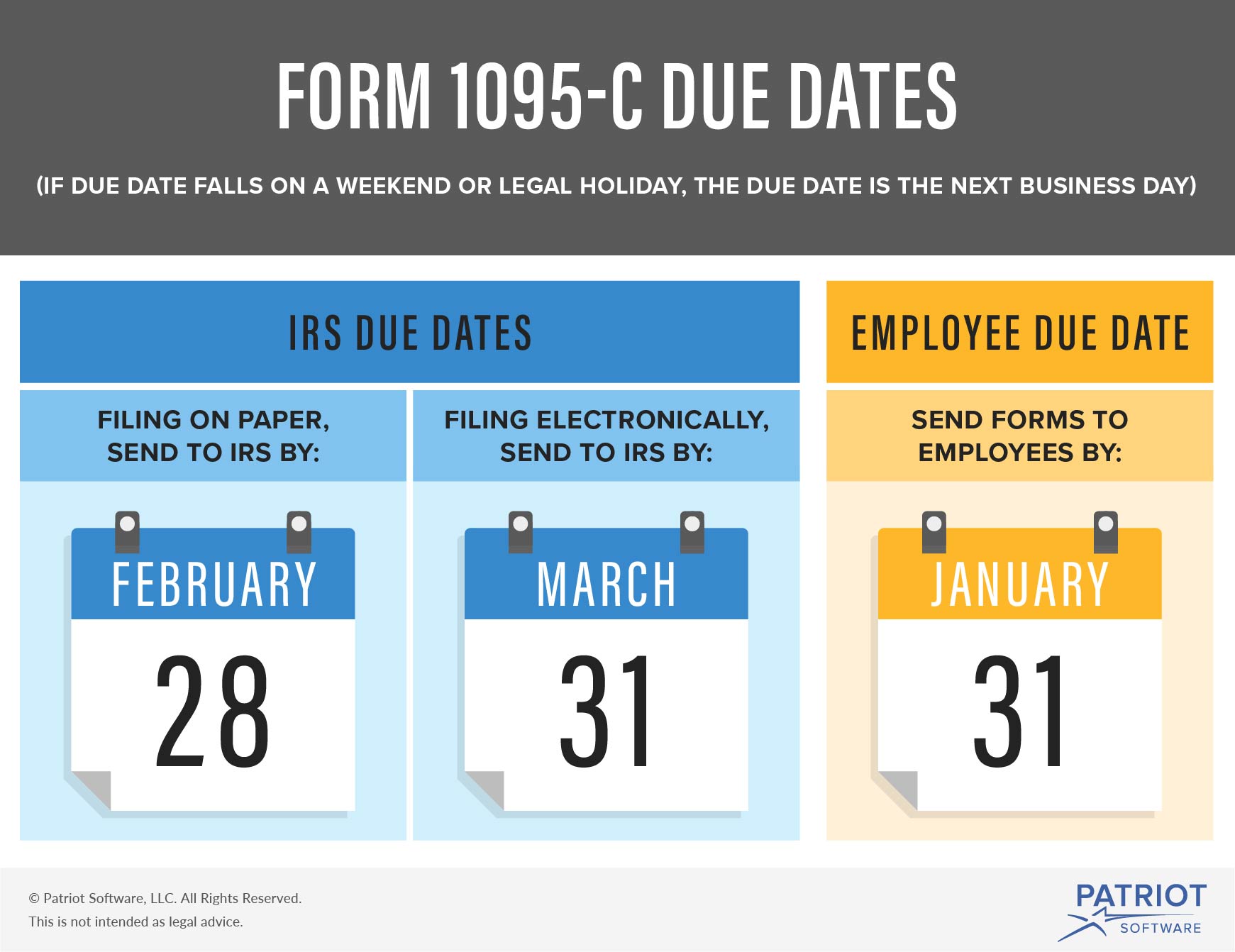

See Instructions for Forms 1094C and 1095C 1095 and 1094 IRS copies for paper filers;Standard Due Date Extended Due Date Forms 1094B and 1094C (Copies of Forms 1095B/1095C) Deadline to File with IRS by Paper If you are an applicable large employer (ALE) under the ACA and have historically filed annual Forms 1095C (along with the Form 1094C Transmittal form) with

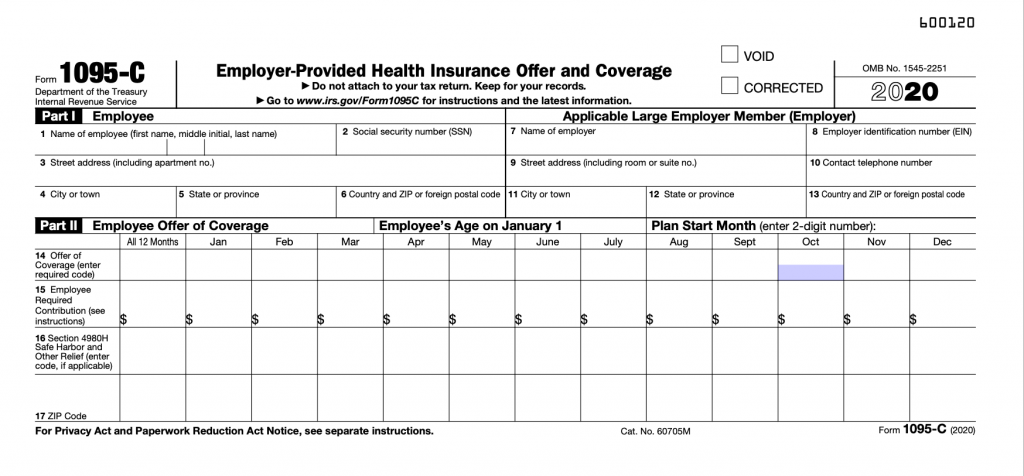

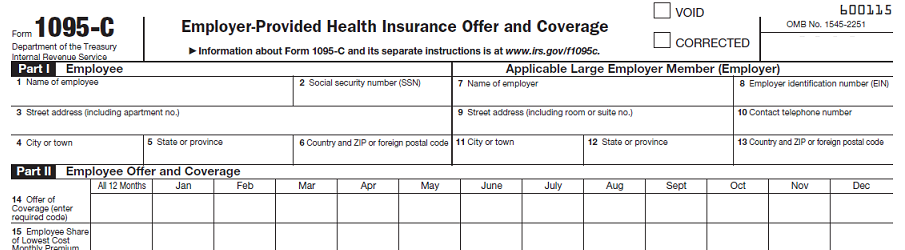

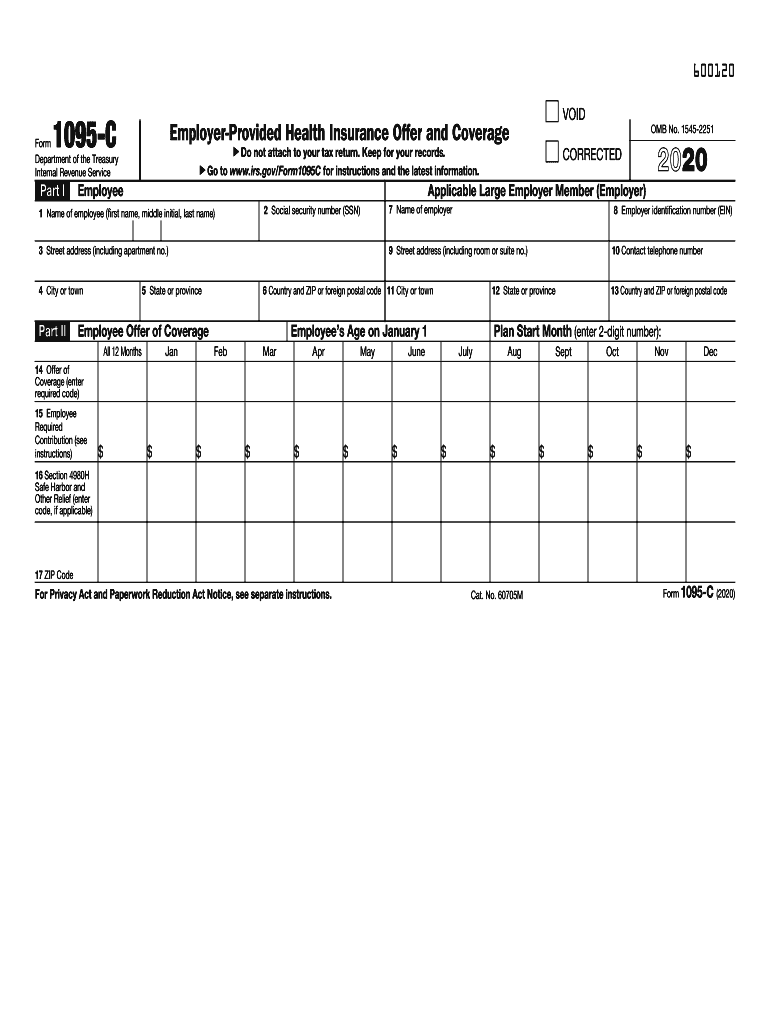

In the IRS released a draft version of Form 1095C which confirms that the IRS has added new ACA codes (1T to 1U) to be entered on Line 14, Offer ofForms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information ReturnsWhat Is Form 1094C?

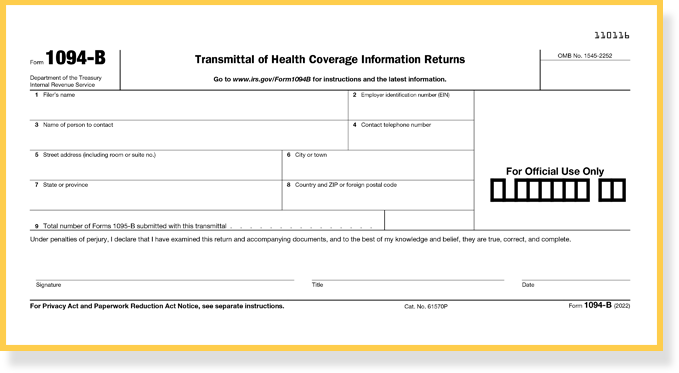

Form 1094c instructions 21 Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?IRS Filing Deadline (eFile) affordable care act forms 1094/1095B and 1094/1095C The links below are for Tax Year forms Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year Form 1095B – Health Coverage – Tax Year Instructions for Forms 1094B and 1095BThis is the transmittal form filed with the IRS to summarize individual 1095C forms Filing Deadline to IRS by February 28 Compatible with Laser Link Tax Preparation Software (Product ) Please contact us if you need quantities other than those listed We'd be happy to give you a very competitive quote

Form 1095 A 1095 B 1095 C And Instructions

Aca Deadlines Penalties Extension For 21 Checkmark Blog

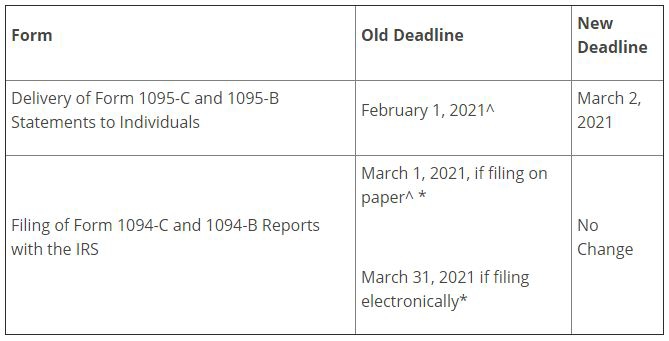

1095 Forms are due from Employers to Employees by 1094 Forms from all other entities are due to the IRS by , if filing electronically or , if filing via paper WHAT IS TO BE FILED? The filing deadline for Forms 1094B, 1095B, 1094C, and 1095C with the IRS remains February 28 th, 21, if filing by paper and March 31 st, 21, if filing electronically Sections 6055 and 6056 provide the IRS with the ability to grant extensions of up to 30 days for furnishing Forms 1095B and 1095C when good cause is demonstrated On , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from

Tax Form Preparation For 21

Your 1095 C Obligations Explained

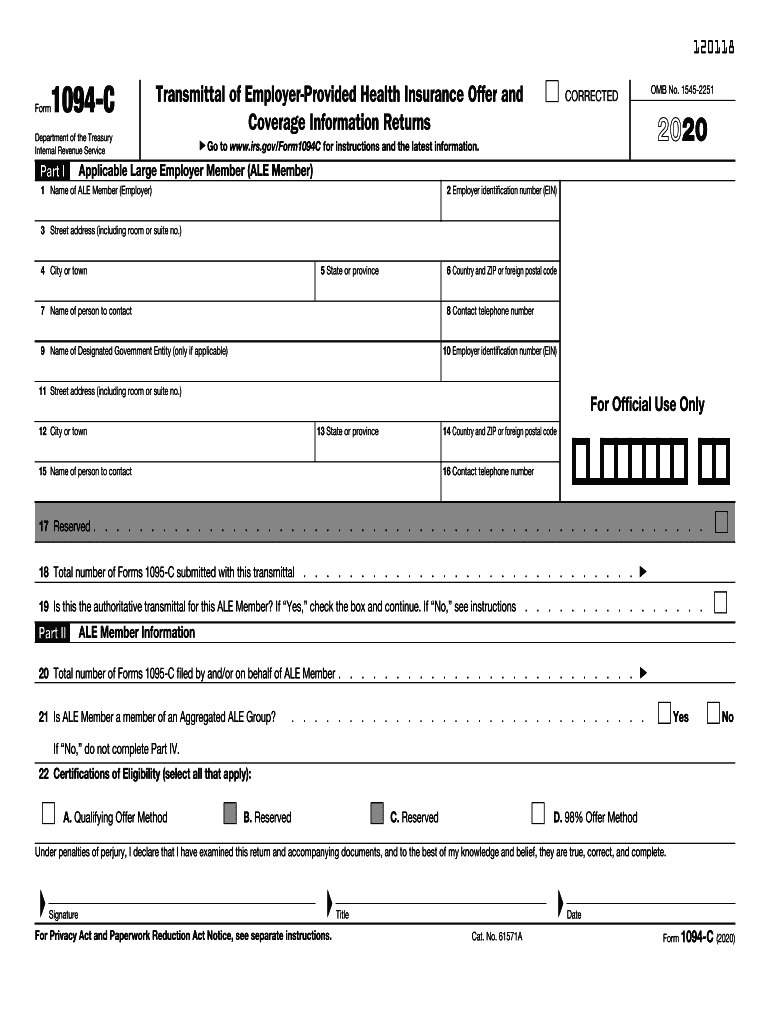

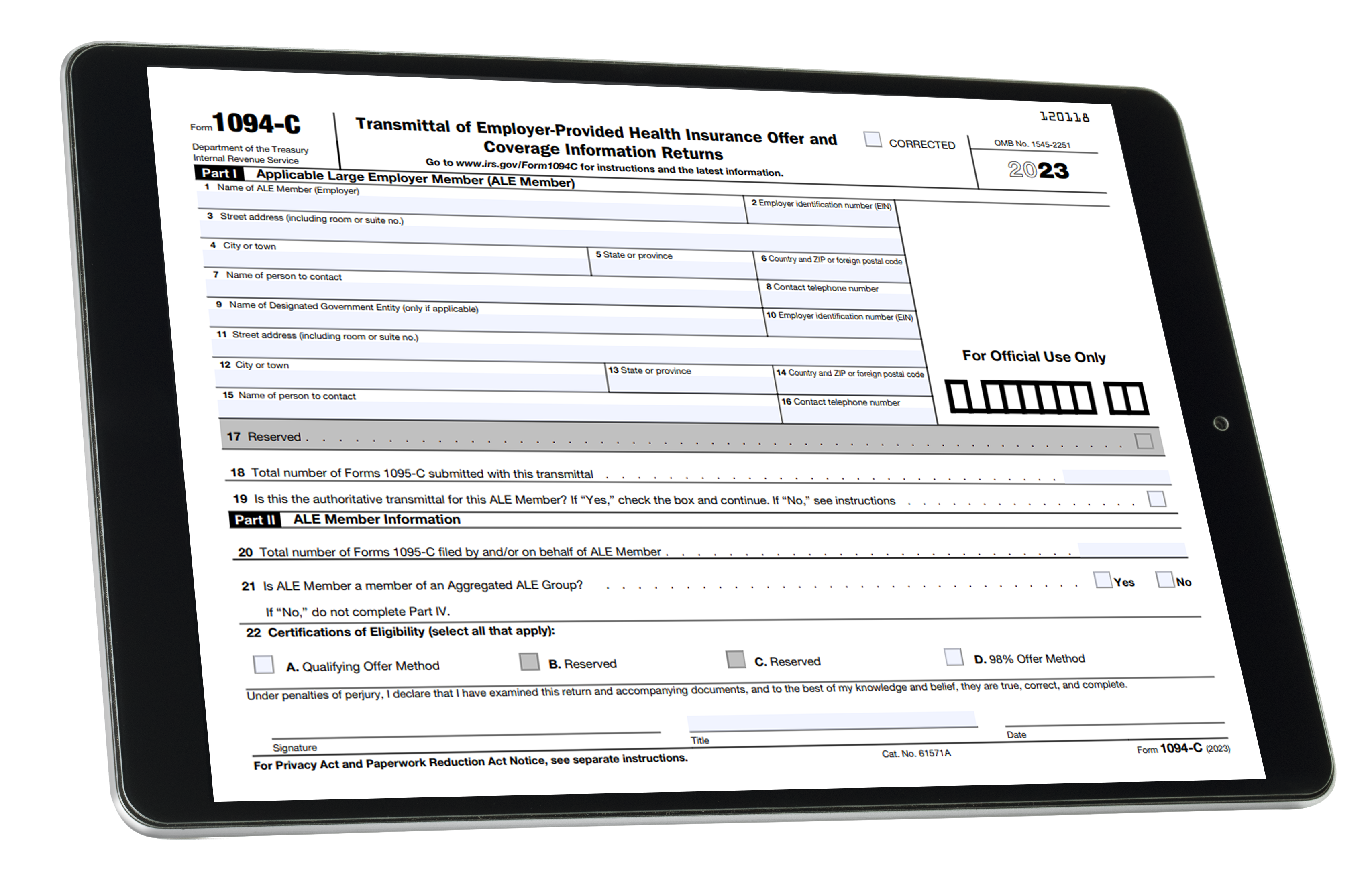

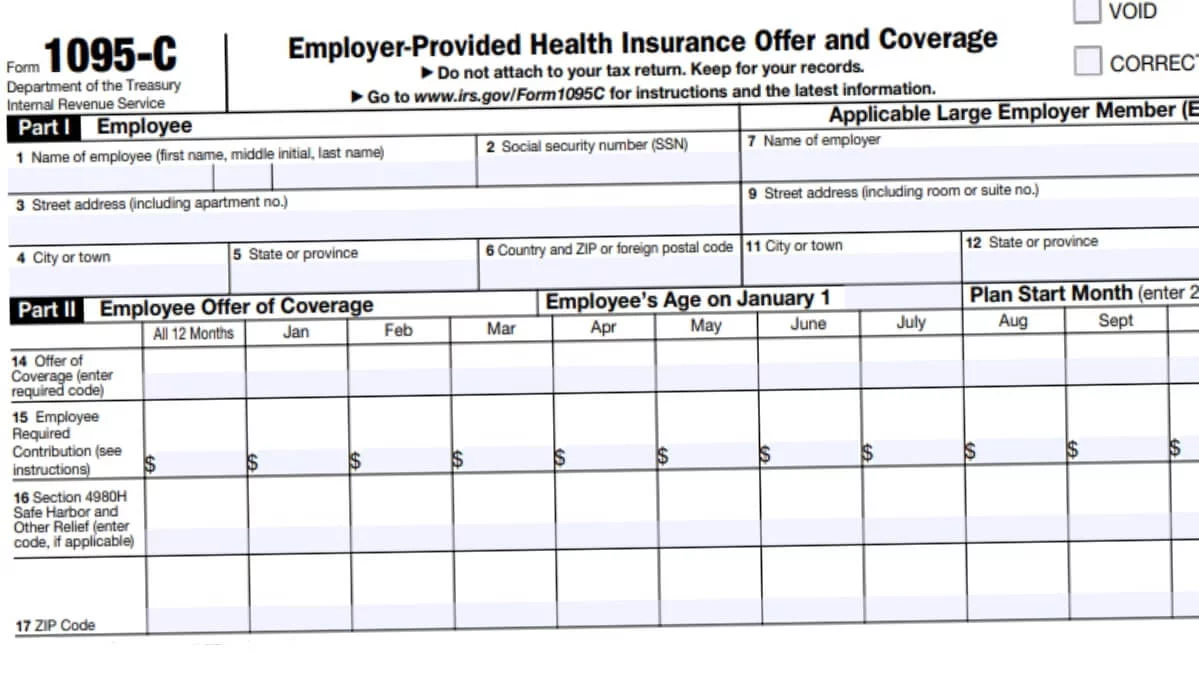

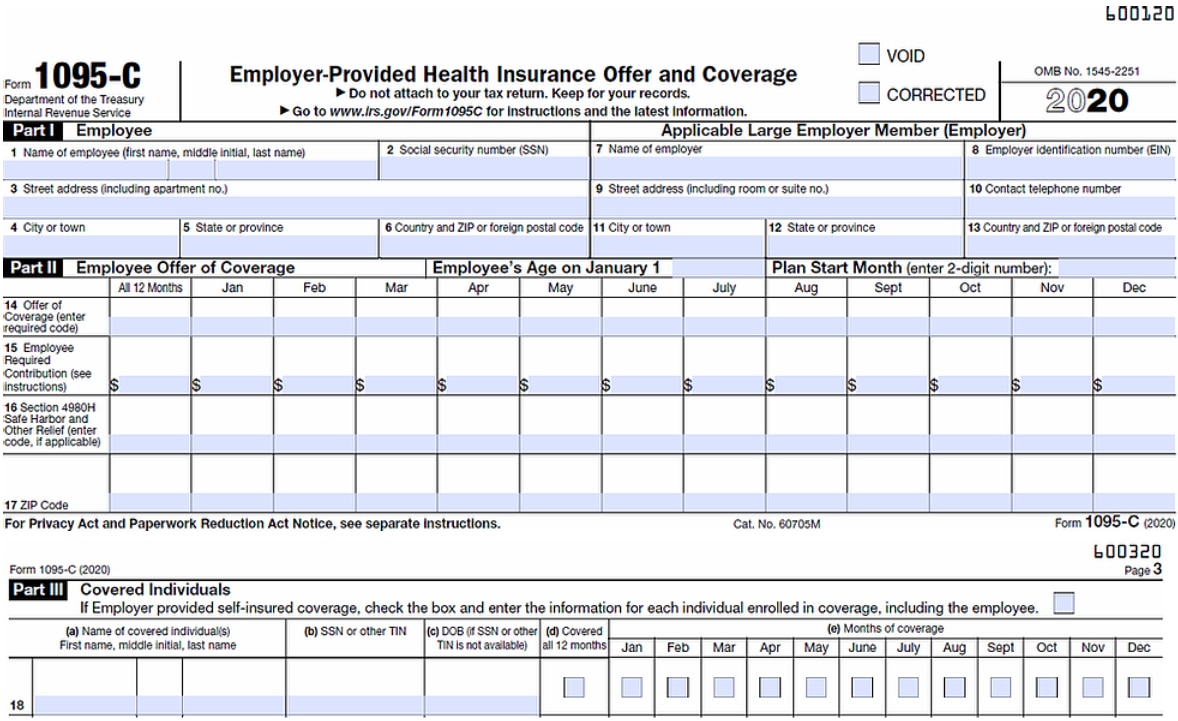

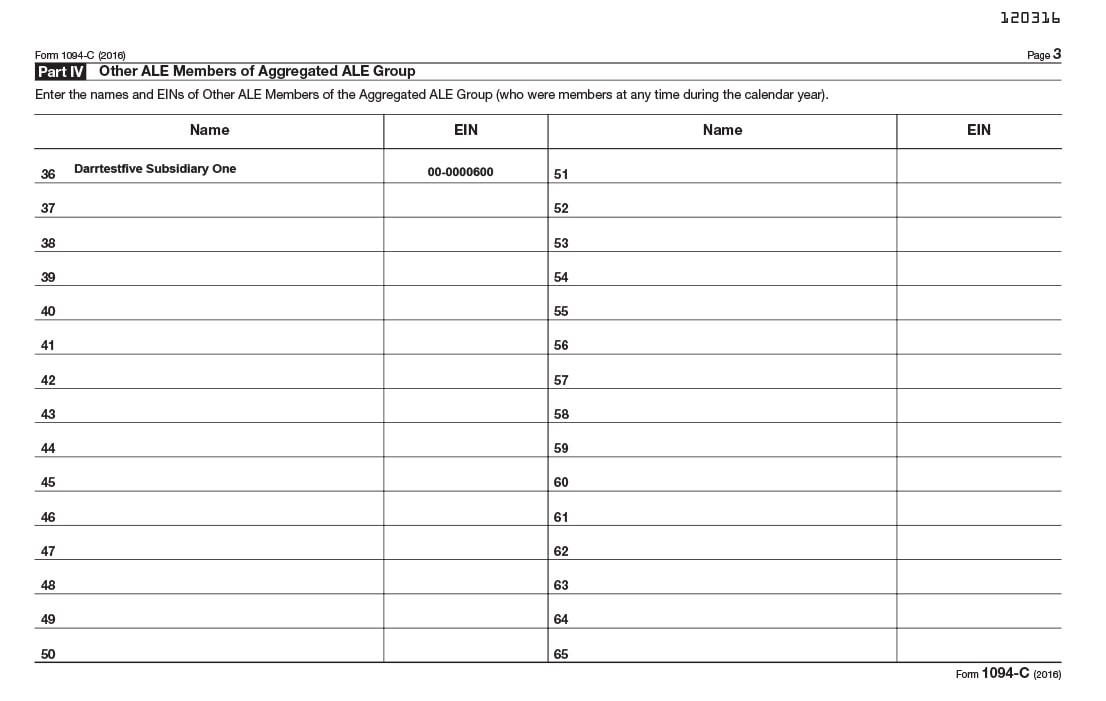

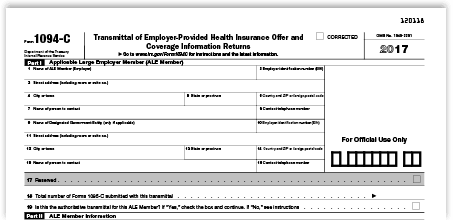

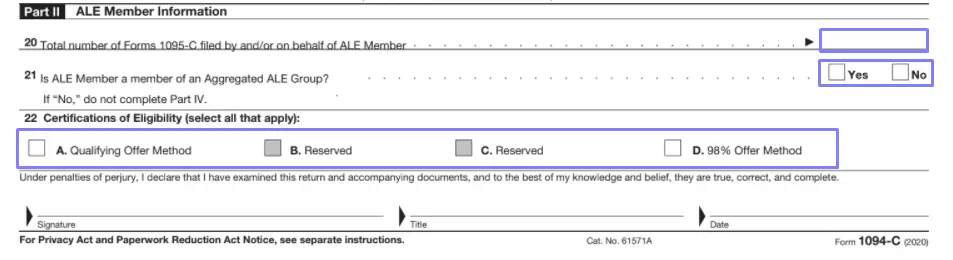

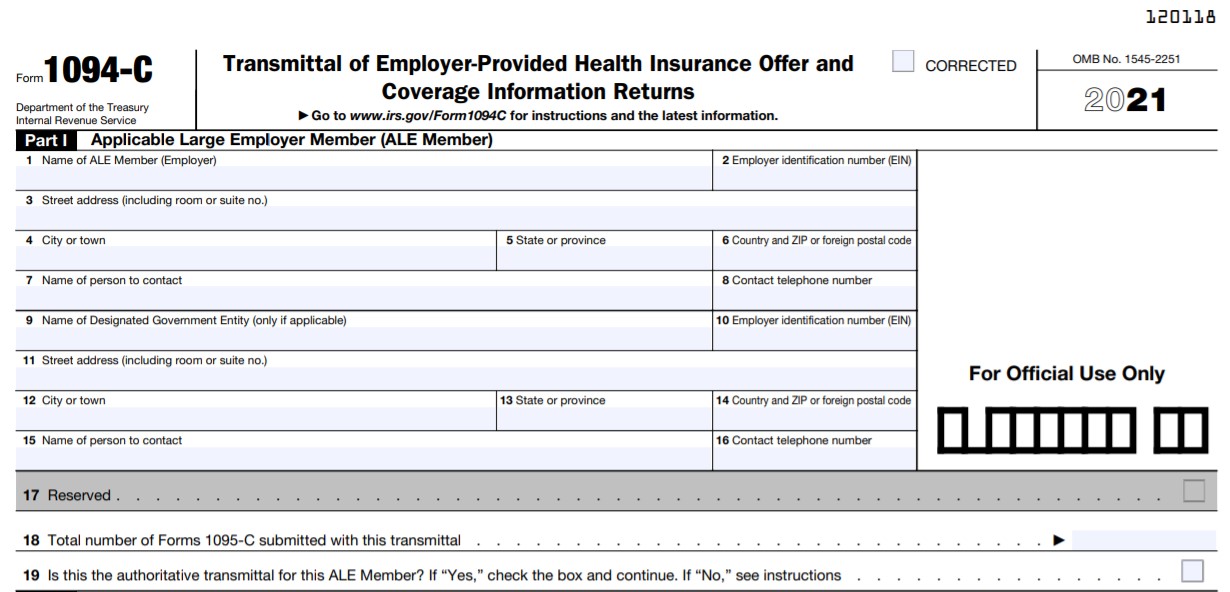

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C1094 C 1094C is one of the IRS forms filed by employers (along with Form 1095C) Any business owner with employees must submit these forms when they are required to offer employees health insurance coverage under Obamacare, also referred to as the Affordable Care ActThe 1095C contains a wealth of information regarding health insuranceForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

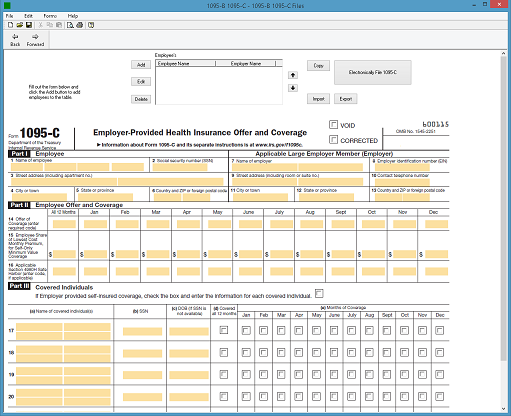

1095 Software Ez1095 Affordable Care Act Aca Form Software

Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper§6056 via Forms 1094C and 1095C) for the 21 calendar year that is reported at the beginning of 22 Note §6055 reporting via Forms 1094B and 1095B will apply if the employer offered a selfinsured medical plan Employer is subject to potential Understanding ACA Forms 1094C/1095C Robert Sheen ACA Reporting , Affordable Care Act Employers required to comply with the ACA's Employer Mandate must report their fulltime employee's healthcare information to the IRS annually via forms 1094C and 1095C, but what exactly are these forms?

Graydon Law

Irs Issues Draft Form 1095 C For Aca Reporting In 21

The deadline for filing Forms 1094B, 1095B, 1094C or 1095C with the IRS remains , or , if filing electronically As a reminder, employers who are filing more than 250 of these reporting forms are required to file electronically The IRS has released final forms and instructions Submission to the IRS Forms 1094C, 1095C, 1094B, and 1095B forms must be filed with the IRS by if filing on paper (or March 31 if filing electronically) Electronic filing is mandatory for entities required to file 250 or more Forms 1095Source TYPE OF EMPLOYER 1094B / 1095B 1094C / 1095C SelfFunded ALEs 9 Sent by employer

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Releases New Draft Of 21 Form 1095 C For Filing In 22

The IRS recently released its draft 1094C and 1095C instructions for the 21 tax year We've identified the changes below It appears that Form 1094C will remain the same, but the instructions do include two new codes for use on Line 14 of the Form 1095C 1T and 1U According to the draft instructions, the 1T code is for use when the In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting documentWhile not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs Tax Year 21 Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10 AATS and Production Start and End Dates Posting Dates Start Date End Date AATS Date TBD Production Date TBD TBD Release Memo, XML Schemas and Business Rules

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

Applicable large employers (ALEs) will use the final version of the form in early 21 to show that their health coverage complied with the Affordable Care Act (ACA) during The reporting stipulation states that an information return will be prepared for each applicable employee, and these returns must be filed with the IRS using a single transmittal form (Form 1094B & 1095B or Form 1094C & 1095C) The filing requirements are based on an employer's health plan and the number of employees Updated for Tax Year / 0225 PM OVERVIEW IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare

Payroll Systems Things To Consider When Filing Forms 1095 C 1094 C Payroll Systems

Irs Gov

Forms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information Returns Yes, employers can submit copies of Forms 1094/5C or 1094/5B that they submitted to the IRS for ACA reporting Additional Resources California Franchise Tax Board Individual Mandate webpage;Form 1094C is used to report summary information for your company and to transmit Forms 1095C An employer must file Form 1094C when filing one or more Forms 1095C for its fulltime employees Form 1095C is used to report information about each employee Note The deadline to paper file Forms 1094C and 1095C was If

1095 C Form Official Irs Version Discount Tax Forms

Aca Reporting Solution 1095 B 1095 C Online Filing

Wage Withholding CR 0100AP Business Application for Wage Withholding Tax Account DR 1093 Annual Transmittal of State W2 Forms DR 1094 Colorado W2 Wage Withholding Tax Return DR 1098 Colorado Income Tax Withholding Worksheet for Employers ( The original deadline to provide these Forms to insureds/employees was ;IRS Issues Draft Form 1095C / 1094C for ACA Reporting in 21 Click here to learn more about the changes in ACA Forms

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Form 1094 C Fill Out Printable Pdf Forms Online

The Department of Treasury recently released proposed regulations that would practically make electronic reporting for the Forms 1094C and 1095C mandatory for all applicable large employers beginning with the 21 reporting season For returns filed in 22, employers who are required to file 100 or more Forms 1095C, Forms 1099, Forms W2, andIn early May, 21, the IRS released a Form 1095C draft, which adds two new 1095C codes 1T and 1U for employers to meet the ICHRA reporting requirements An ICHRA is an employersponsored reimbursement plan that allows employees to purchase their health insurance plan privately or on the open market is the deadline for large employers and employers with selffunded plans to file certain Affordable Care Act forms with the IRS (Forms 1094C, 1095C, and Forms 1095B), if the employer is filing on paper is the deadline for health plans to report small HIPAA breaches occurring in

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Affordable Care Act Deadlines Extended For Notices Lexology

Disclaimer This content is intended for informational purposes only and should not be construed as legal, medical or tax advice Know your ACA reporting requirements for tax year and efile your ACA 1094/1095 Forms before the 21 deadline Avoid receiving ACA penalty letters and paying millions of dollars as penalties! 1095B/1095C ACA Filing "Print, Mail, & eFile" & "eDelivery/Print/eFile" orders must be completed by 3/2/21 at 7am (PDT) "eFile Only" orders must be completed by 12pm (Noon, PDT) on The IRS has officially provided notice that the deadline for furnishing (printing & mailing) IRS forms 1095B & 1095C is now extended to March 2nd

Changes Coming For 1095 C Form Tango Health Tango Health

Irs 1094 C Form Pdffiller

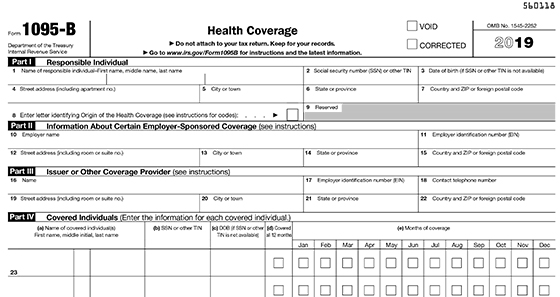

Form 1095B Health Coverage Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A Health Insurance Marketplace Statement 21 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C The 21 ACA reporting deadlines for the Forms are now as follows Forms 1095B and 1095C Deadline to Furnish to Individuals;Dependents on forms 1094B and 1095B Forms are due to individuals by January 31 of the year immediately following the calendar year to which the reporting refers to JANUARY 21 RequirementDeadlineDescription Section 6055 and 6056 Reporting 1094C 1095C 1094B 1095B Filing deadline with the IRS for paper forms February 28 (March 31, if

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Finally, the IRS will send a Letter 5699 to any employer who the IRS believes was an ALE in an applicable tax year and from whom the IRS did not receive a 1094C or any Forms 1095C The IRS uses the number of W2s filed by an employer (on an EIN basis) as a basis for its belief that Forms 1094C and 1095C were required to be filed Also, the filing deadlines were not extended for Forms 1094B, 1095B, 1094C, or 1095C with the IRS, all of which must be filed by , or efiled by The term "filing" means submitting the forms to the IRS, either electronically or through mailForm 1094C Filing Deadline Beginning with the 18 tax year, employers must file Form 1094C to the IRS with Form 1095C Both forms are due to the IRS by February 28 th (if paper filing) or April 01 nd (if efiling) of the year following the calendar year the return references If the regular due date falls on a Saturday, Sunday, or legal

How To Correct Form 1094 1095 Errors The Cip Group

Irs Gov

To Employee January 31 (Extended to ) Form 1094C What is an "authoritative transmittal?" If you have only one Form 1094C, that Form 1094C must report aggregate employerlevel data for the ALE Member and be the Authoritative TransmittalOverview of Form 1094C Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment The IRS has released draft Affordable Care Act (ACA) information reporting forms and instructions for 21 As a reminder, Forms 1094B and 1095B are filed by minimum essential coverage providers (insurers, governmentsponsored programs, and some selfinsuring employers and others) to report coverage information in accordance with Code § 6055

trix Irs Forms 1094 C

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Aca Filing Services 6055 Reporting Form 1094 C

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

21 Aca Reporting Is Due In Early 22 Hr Works

1094 C 1095 C Software 599 1095 C Software

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Free Small Business And Hr Compliance Calendar March 21 Workest

1095 Software Ez1095 Affordable Care Act Aca Form Software

Irs Gov

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Fairviewinsurance Com

Irs Form 1094 C Fill Out Printable Pdf Forms Online

21 Aca Compliance Checklist For Employers Integrity Data

1095 Software Ez1095 Affordable Care Act Aca Form Software

About Form 1094 Turbo Tax

1095 C Form 21 22 Irs Forms

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Filing Form 1094 C Youtube

1095 C Faqs Mass Gov

3

Irs E Filing Deadline March 31 22 Aca Gps

1094 C Form Transmittal Discount Tax Forms

1094 C Example

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Smaller Employers Beware Irs Doesn T Want Paper Aca Filings Next Year Or Paper W 2 And Similar Filings For That Matter

Irs Form 1094 Aca Form 1094 Affordable Care Act Aca Reporting

Form 1094 C And 1095 C And Other Ale Consultations Haffraggiolaw

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Vehi Org

Updated Download Form 1094 C Android App 21

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Aca Compliance Filing Irs Forms 1094 C And 1095 C

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

What Is The Difference Between Forms 1094 C And 1095 C Turbotax Tax Tips Videos

1094 C 1095 C Software 599 1095 C Software

Your 1095 C Obligations Explained

Bluechoicesc Com

Irs Form 1094 C Fill Out Printable Pdf Forms Online

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1094 C And Form 1095 C B Benchmark Planning Group

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Dgb Online Com

Irs S Draft 21 Aca Reporting Forms And Instructions Incorporate Some Expected Changes Omit Others

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Corpsyn Com

Irs Gov

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Pgpbenefits Com

The 21 Dates Deadlines For Aca Reporting Are Imminent

Ez1095 Software How To Print Form 1095 C And 1094 C

Common Mistakes In Completing Forms 1094 C And 1095 C

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

.png)

Flock Platform Hr Benefits Compliance Software

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Reporting Determining A Company S Ale Status Integrity Data

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

1095 C Form Official Irs Version Discount Tax Forms

What S The Difference Between Forms 1094 1095 Primepay

Vehi Org

trix Irs Forms 1094 C

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

How To Fill Out Forms 1094 C 1095 C Employer Health Coverage Youtube

1094 C Irs Transmittal For 1095 C Forms For 21 5500 Tf5500

Extension Of Deadlines For Aca Reporting By Employers Ncw Insurance In Amarillo Texas

1094 C Due Date Fill Online Printable Fillable Blank Form 1094 B Com

E File Aca Form 1095 C Online How To File 1095 C For

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Ez1095 Software How To Print Form 1095 C And 1094 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

No comments:

Post a Comment